McKinsey invites us to Meet the next-normal consumer in a recently-published research report describing changing consumer behavior responding to the COVID-19 lockdown and aftermath.

The report gives us insights into the next-normal health consumer, which I’ll discuss in today’s post.

The report gives us insights into the next-normal health consumer, which I’ll discuss in today’s post.

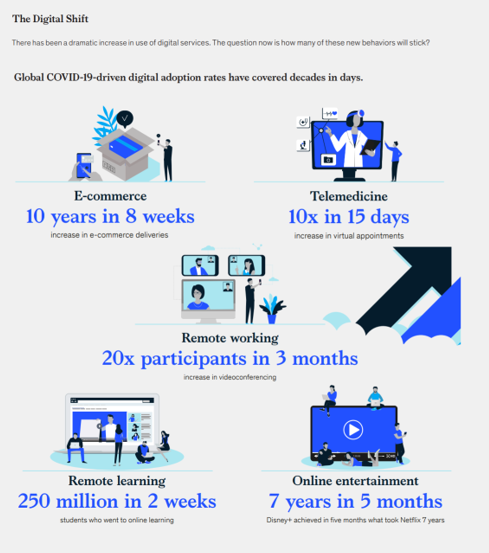

Note the massive digital shift every person living in a country touched by the coronavirus has experienced, illustrated in the first graphic from the report. Tele-work, tele-education, ecommerce, and streaming entertainment all grew so fast within a matter of a few weeks.

And telemedicine, McKinsey points out, was adopted at a rate of ten times growth over 15 days, the chart quantifies as an increase in virtual appointments.

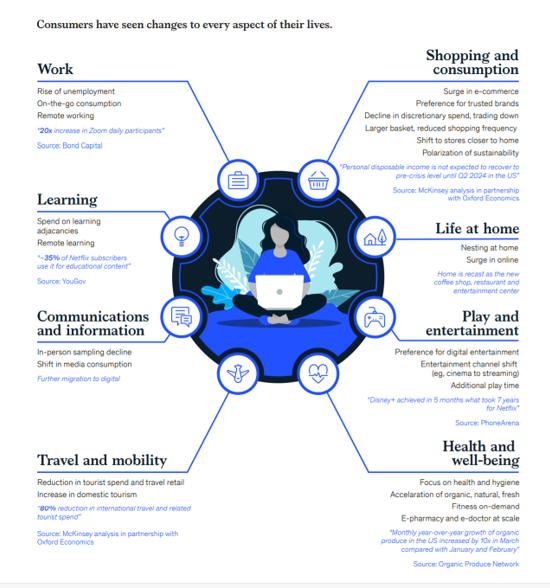

The key points in the report is that COVID-19 is changing how consumers behavior across all aspects of living, calling out eight areas:

- Work

- Learning

- Communications and information

- Travel and mobility

- Shopping and consumption

- Life at home

- Play and entertainment, and

- Health and well-being.

Self-care became a priority for most consumers in the early phase of the pandemic. Online searches for telemedicine increased more than nine-fold during the crisis, McKinsey noted.

For health and well-being impacts, McKinsey identified consumers’ growing focus on health and hygiene; accelerated growth in organic, natural, and fresh food; fitness on-demand; and, e-pharmacy and e-doctors at scale.

In fact, the other seven areas beyond health and well-being are adjacent to health, especially shopping and consumption (e.g., healthy food, over-the-counter medicines, and exercise equipment); learning, for self-care personal work-flows whether seeking information on how to use a remote health monitor, read a prescription drug label, or take a meditation or healthy cooking course; and, play and entertainment, for relaxing, family bonding, and gaming with friends via social gaming platforms that mitigate loneliness and feelings of isolation.

In fact, the other seven areas beyond health and well-being are adjacent to health, especially shopping and consumption (e.g., healthy food, over-the-counter medicines, and exercise equipment); learning, for self-care personal work-flows whether seeking information on how to use a remote health monitor, read a prescription drug label, or take a meditation or healthy cooking course; and, play and entertainment, for relaxing, family bonding, and gaming with friends via social gaming platforms that mitigate loneliness and feelings of isolation.

By now, six months into the pandemic, more patients have returned to health care settings for elective surgery, cancer treatments, and other types of delayed health care services.

But not all patients have done so, with a cohort of people managing chronic conditions or acute issues still concerned about exposure to the coronavirus outside of the hygienic home.

Will health consumers who used virtual care settings continue to do so once the pandemic eases, say in the second quarter of 2021?

McKinsey raises the importance of consumer experience in the pandemic across all the changed personal life-flows, whether ordering groceries via Instacart, convening meetings via Zoom through the tele-work days, or seeking telehealth through their local health system provider or a national telemedicine brand.

While telehealth services rose to the pandemic occasion and enabled patients and physicians to engage in virtual encounters, the experiences on both sides of the clinical conversation were not uniformly enchanting.

“While the use of e-pharmacies and e=doctors has doubled or tripled int he United States over the course of the crisis, only 40 to 60 percent of consumers express an intent to continue using those services,” McKinsey writes in the report.

Health Populi’s Hot Points: To answer what that “next normal” for health consumers will be requires foresight on several key factors that will shape health consumer demand after the pandemic:

- Payment, where out-of-pocket costs have played a role in people seeking care before the pandemic, and certainly during the COVID-19 crisis

- Convenience, where that patient-as-payor is looking for service and access closer to home in the community, or inside the home or on the phone-in-hand

- Health insurance markets after the 2020 election: there are many scenarios we’re exploring for this factor. A Biden Presidency with a Democratic Congress in both houses would portend a very different health reform outcome than a Trump Presidency with a continue split legislature. Scenario planning required here!

- Evolving technology and digital health industry innovations, bringing more care and services direct-to-consumers, and growing hospital-at-home programs

- and other driving forces.

With these uncertainties, there’s one certainty to plan with: the growing trust among consumers for health care workers, front-line heroes in the pandemic, and a general (although not universal) trust in medical expertise. A big wild card for scenario planning in the coming weeks and months will be the development and launch of vaccine(s) to treat the coronavirus. Today we learned that there “could” be a vaccine available for some people in the U.S. by “early November,” just around the U.S. national election date of 3rd November 2020. Trust, already eroding vis-à-vis the CDC and FDA, could be further compromised.

This week, a STAT-Harris Poll found that 8 in 10 Americans worry the COVID-19 vaccine approval process is being driven more by politics than science. And in a kumbaya moment, this response was pretty bipartisan: 72% of Republicans and 82% of Democrats expressed the concern.

If the next-normal for health consumers is lack of trust in science and scientists, the U.S. is on a slippery slope to a retro era of high-risk snake oil.