Pfizer has gone from first to worst.

Merck. But so far 2019 has been a very different story for the stock. It’s the biggest drag on the Dow this month, with the shares losing more than 9 percent.

The New York-based company is scheduled to report fourth-quarter earnings on Tuesday before the bell, and two Street watchers say to steer clear. Ari Wald, head of technical analysis at Oppenheimer, believes there are better stocks to own in the broader health-care sector, while Gina Sanchez, CEO of Chantico Global, believes Pfizer’s push into oncology may jeopardize the company’s top line.

“For us large-cap pharma is a very defensive bet … [Pfizer] did have a great second half of 2018, benefiting as that safe haven asset,” Wald said Monday on CNBC’s “Trading Nation.”

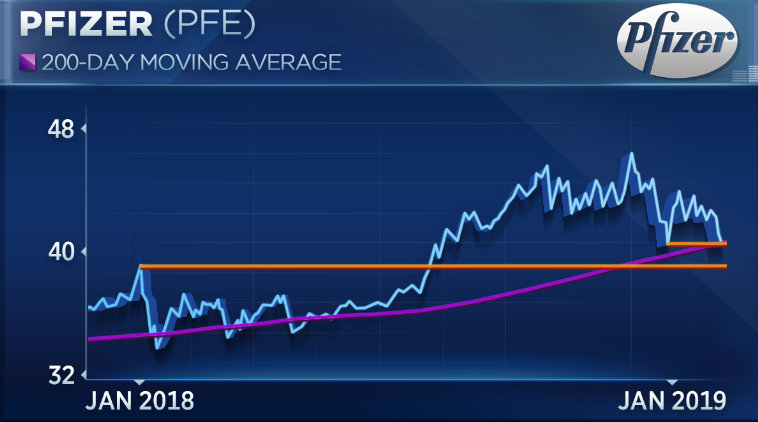

As the broader market sold off at the end of 2018, investors rotated into more defensive, secular plays like health-care stocks. In this flight to safety, Pfizer’s shares rose, ultimately hitting a 52-week intraday high of $ 46.47 on Dec. 4.

But Wald believes investors once again have an appetite for potentially trickier trades, meaning they could keep selling Pfizer shares in favor of higher-growth companies, for instance.

“Our concern is that it [Pfizer] could then become a source of funds as risk-taking slowing comes back to the market. We’re already starting to see signs of that,” Wald contended.

That said, while the shares are currently trading beneath their 200-day moving average — a key technical indicator used to analyze a stock’s price trend — Wald isn’t anticipating major downside.

“There’s a lot of support at $ 39, so we don’t necessarily expect a lot of downside here, we just see more attractive opportunities elsewhere in the sector,” he said.

Like Wald, Sachez is avoiding Pfizer ahead of earnings.

“The issues on Pfizer are very Pfizer-specific,” she said. “They’re really putting their bets on the oncology market, which is becoming more and more competitive … they’ve really made a bet on the cancer market — we’ll have to see how that plays out this year,” she contended.

According to FactSet estimates, analysts are expecting Pfizer to report earnings of 63 cents per share on $ 13.9 billion in revenue.