Dive Brief:

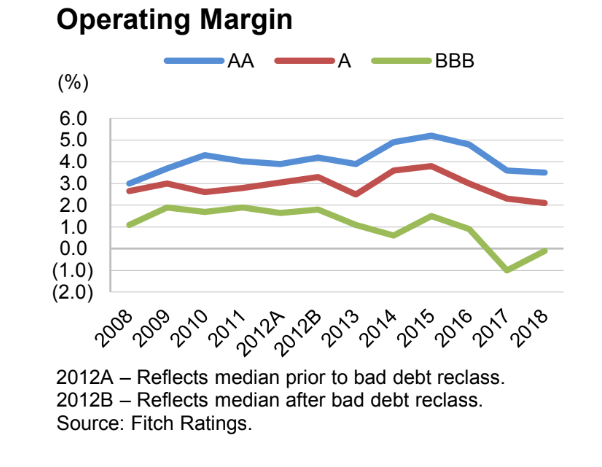

- Nonprofit hospitals’ operating margins are improving after falling for the last two years, according to an annual report on hospital performance from Fitch Ratings.

- Smaller hospitals are driving the turnaround and it’s a notable trend because they’re not able to command higher rates from payers like their peers the “must-have” hospitals, according to the report.

- “The fact that [smaller hospitals] saw meaningful improvement is a good indicator that operational strength is returning to the sector, though the highs we saw in 2015 may be an unattainable highwater mark,” Kevin Holloran, senior director for Fitch, said in a statement.

Dive Insight:

The industry continues to experience pressures including slowing inpatient admissions and more patients covered by government-sponsored health insurance such as Medicare, which typically reimburses at a lower rate compared to commercial insurers.

Wages are also under pressure amid a tight labor market, and the need to shift to to an environment that is increasingly reimbursing for quality — not quantity.

The question now is whether these recent gains are a “temporary blip” or a major shift, Fitch analysts noted.

“Not-for-profit hospitals are by no means out of the woods yet with sector pressures likely to continue, but there appears to be light at the end of the tunnel in terms of longer-term stability,” Holloran said.

Fitch Ratings

Still, despite the margin improvement, Fitch maintains a negative outlook for the sector.

Even still, “the not-for-profit healthcare sector has shown considerable resiliency over the years, weathering events like the 2008/2009 great recession, sequestration cuts to governmental funding, and a shifting payor mix,” Fitch analysts said.

Fitch believes consolidation among providers will continue. Providers will focus on increasing their size and scale to maintain leverage over insurance companies and allow them to invest in population health.