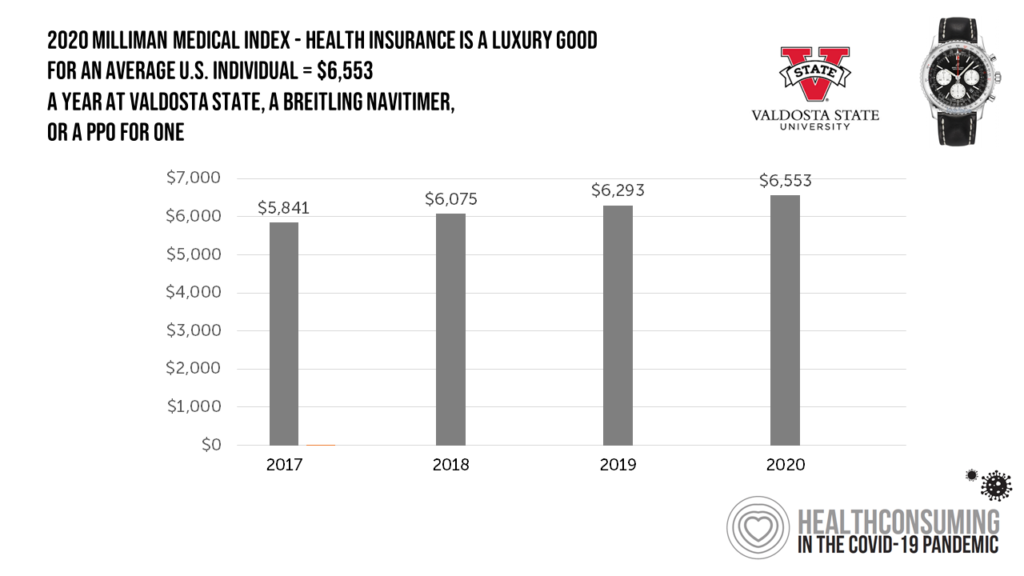

Imagine this: you find yourself with $ 6,553 in your pocket and you can pick one of the following:

Imagine this: you find yourself with $ 6,553 in your pocket and you can pick one of the following:

- A new 2020 Breitling Navitimer watch;

- A year’s in-state tuition at Valdosta State University; or,

- A PPO for an average individual.

Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee.

That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report.

Milliman bases the MMI on actual claims data from health plans; estimates of cost changes from 2018 and 2019; and, research on how MMI’s costs for the hypothetical family of four differ from those of an individual.

Milliman bases the MMI on actual claims data from health plans; estimates of cost changes from 2018 and 2019; and, research on how MMI’s costs for the hypothetical family of four differ from those of an individual.

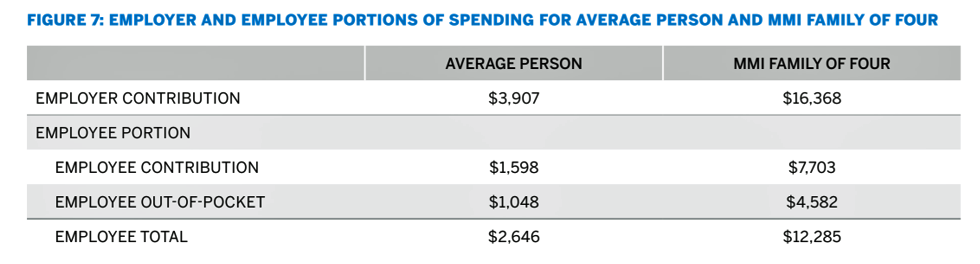

As my focus here is on the patient-as-the-payor, I appreciate that Milliman parses the split between employer and employee shares of health care spending. The table details the health care cost share for both the individual person and the family of four. You can see at this granular level that the PPO costs for an individual are not simply one-fourth of those for a family of four based on Milliman’s methodology.

Consider the family of four PPO spending of $ 28,653: the employee share will comprise 42% of the total, equal to $ 12,285. In 2020, that $ 12K+ represents over 18% of the median household income in the U.S. of $ 66.5K, close to $ 1 in $ 5 of gross income before taxes.

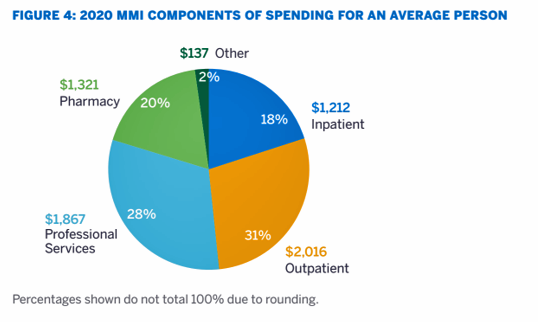

Looking at the components of spending, one-half will be allocated to hospitals including inpatient care (18%) and outpatient ($ 2,016). Another 28% will go to professional services to clinicians and other licensed providers; and, 20% of spending will be devoted to pharmacy expenses (prescription drugs).

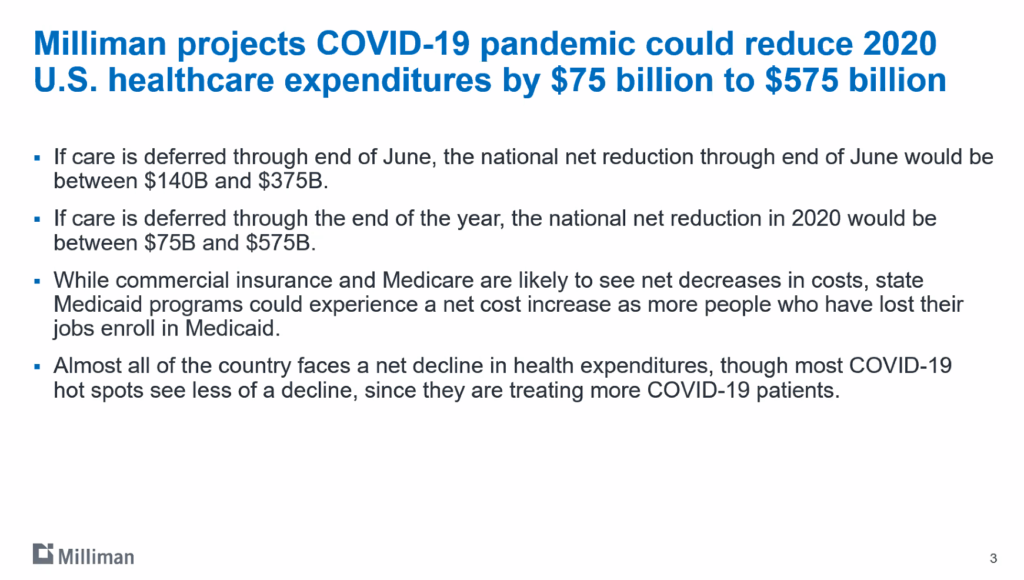

Health Populi’s Hot Points: The COVID-19 pandemic will dramatically impact the U.S. macroeconomy and, to be sure, the nation’s health care economy. Before publishing the MMI today, Milliman had already recognized that the coronavirus will profoundly re-shape American health care costs and delivery workflows. Top-line, there are new-new costs borne in 2020 for virus testing and treatment. Some hospitals have emerged as de facto COVID-19 treatment centers; other inpatient providers have not, with the phrase “ghost town” used in media to describe these organizations. These are particularly rural providers, but other institutions from urban to suburban aren’t exempt from this effect.

Health Populi’s Hot Points: The COVID-19 pandemic will dramatically impact the U.S. macroeconomy and, to be sure, the nation’s health care economy. Before publishing the MMI today, Milliman had already recognized that the coronavirus will profoundly re-shape American health care costs and delivery workflows. Top-line, there are new-new costs borne in 2020 for virus testing and treatment. Some hospitals have emerged as de facto COVID-19 treatment centers; other inpatient providers have not, with the phrase “ghost town” used in media to describe these organizations. These are particularly rural providers, but other institutions from urban to suburban aren’t exempt from this effect.

At the same time, patients who might otherwise have sought care for chronic conditions and elective surgeries have put off that demand for inpatient and outpatient spending.

Net-net, even the brilliant actuaries at Milliman can’t know (yet) how the pandemic will hit 2020 costs, so the PPO indices for individuals and families do not make any assumptions about COVID-19 impacts.

The fourth bullet in the slide here states Milliman’s bottom line for 2020, insofar as they can forecast: that most of the U.S. will face a net decline in health spending, even in those hot spots providing intense levels of care to coronavirus patients.

What we know will be consistent in 2020 is that the patient will remain a key health care payor. Health care spending for Americans will feel like a luxury good in the U.S. in 2020, especially as the national economy softens toward a recession or deeper decline.

The complication of the COVID-19 pandemic for health care is that accessing services will feel and look quite different through much of 2020 and, potentially, into 2021: a year of fast-pivoting in-person care to virtual settings and self-care at home, to risk-manage exposure to the virus by shifting away from brick-and-mortar provider settings where that is a viable choice. These new workflows will also impact what the MMI will look like in 2021 and beyond. We may well see a new piece of the pie chart marked, “virtual care” and “self-care” if not in 2021, then by 2022.

There will also be the impact of some millions of people in the U.S. losing health insurance through the loss of jobs in the pandemic that don’t return in the “reopening” phase of the U.S. economy. Recent consumer surveys measuring public sentiment about exposure to the virus versus impact on personal finances, a plethora of people are more concerned about the fiscal/economic impacts than the physical/clinical impacts of the coronavirus.

For your historical context, here’s last year’s write-up on the 2019 MMI.

For your historical context, here’s last year’s write-up on the 2019 MMI.

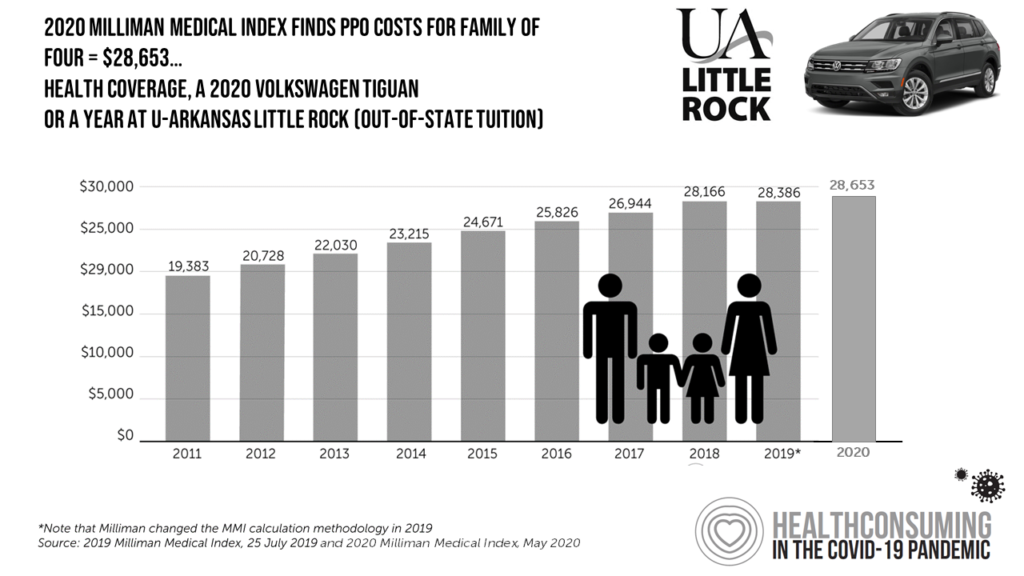

Looking back, looking forward….if you are interested in seeing this year’s family of four PPO spend compared with historic MMI stats, here’s my update based on last year’s graphic which was published in my book, HealthConsuming: From Health Consumer to Health Citizen.

In 2020, the family-of-four spend is equivalent to a year of out-of-state tuition at University of Arkansas-Little Rock, or a new Volkswagen Tiguan SUV.